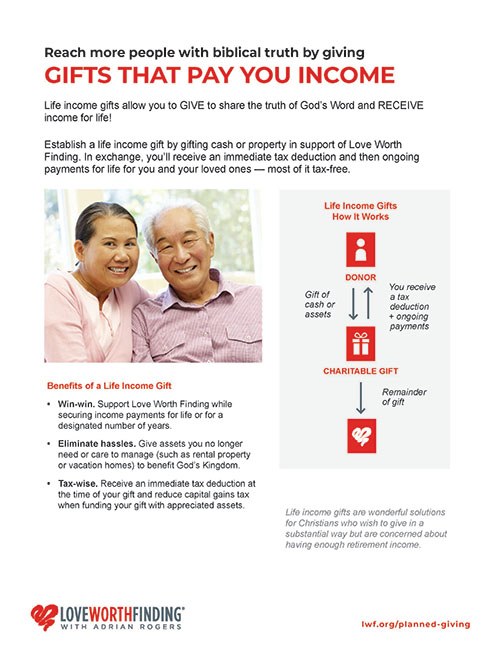

Benefits of a life income gift

Win-win

You help accomplish Kingdom goals while securing income payments for life or for a designated number of years — most of it tax free.

Tax-wise

Receive an immediate tax deduction at the time of your gift and reduce capital gains tax when funding your gift with appreciated assets.

Eliminate hassles

Give assets you no longer need or care to manage (such as rental property or vacation homes). Our professional planned giving partners will help plan and manage asset transfers and sales.

Better returns

Life income gifts pay higher rates than money market accounts.

This information is not intended as tax, legal or financial advice. Gift results may vary. Consult your financial advisor and legal counsel for information and advice specific to your situation.